How Craft Breweries Can Use the Reduced Federal Excise Tax

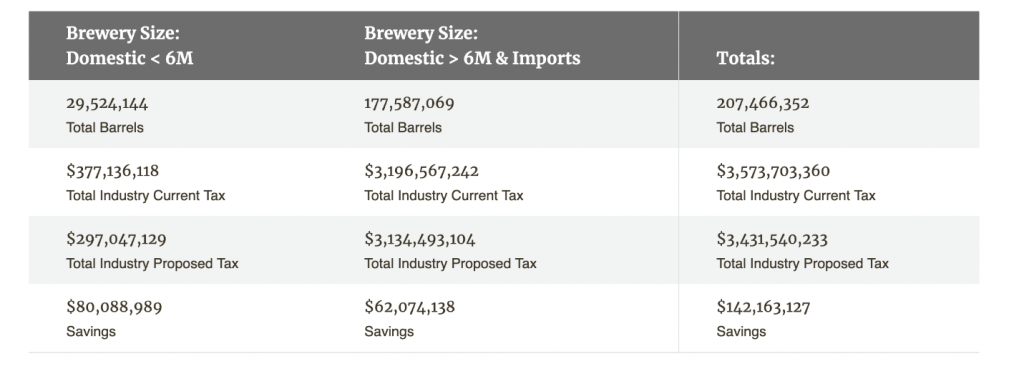

Under the Craft Beverage Modernization and Tax Reform Act (CBMTRA) the Federal Excise Tax (FET) has been temporarily lowered for breweries, wineries and distilled spirit producers until December 31, 2019. Under the current provision, a brewery that produces less than 2 million barrels of beer per year is eligible to pay $3.50 per barrel on the first 60,000 barrels produced.

Once production exceeds 60,000 barrels, the brewer must then pay $16 per barrel in excise tax, which is the same as what large brewers pay at 90 million barrels produced. This past February, several senators re-introduced the Act with the hope that it will become a permanent tax break. The reduction of the FET provides brewers with some additional money to invest in their business. Let’s review several options:

Hire More Staff

To compete more effectively with their larger counterparts across the industry, many brewing companies are using the savings from the reduced FET to hire staff. For example, hiring and training additional staff gives the organization greater flexibility to meet increased demand in the future. It also reduces the long hours that many brewers and employees work due to staff shortages.

Increase Current Employee Benefits

Another great option for harnessing the additional capital is improving the benefits offered to current employees. Studies show that providing employees with tangible incentives, such as health and dental benefits, can increase productivity across the board. For companies intent on maintaining their smaller infrastructure, while retaining access to talented team members, offering benefits could be a great retention option.

Increasing Charitable Contributions

Craft brewing is a community-based industry and for many organizations within the industry, maintaining charitable contributions is important to effective operations. With the lowered FET on their products, growing firms throughout the region could increase donations to charities. Not only does this help spread the word about the brand and their community focus, but it also helps local charities at a challenging time in the national economy.

Buy New Brewery Machinery

For many companies, it’s now the ideal time to invest in new machinery and to innovate within their organization. New machinery is often the best investment as it allows the organization to improve their working productivity and meet demand from other thriving areas of the craft brewing industry.

For example, business owners may invest the extra capital in filling machines to deliver higher levels of production and ensure a consistent, high-quality brew. Before investing in machinery for your business, it is always a good idea to consult with an expert about the latest technology and options. At SMB Machinery, our decades of experience in machine sales and service, have made our team experts who can answer any questions you might have about your potential machinery options.

If the FET rates become permanent, it will benefit over 7,0000 small businesses in the US. Breweries can help by contacting elected officials and Congress. Click here to find your elected officials and reach out.

Considering investing in new equipment for your brewery? Call or email our experts. We’re here to help.